To Infinity… And Beyond!! (Again?)

As we write this, equity markets are ripping higher, with the SPX up nearly 5.5% on the day. The general consensus seems to be that the worst is well in the rearview mirror and the horizon has only sunshine and rainbows. The near unanimous view on this is, well… worrisome. Everyone expects and assumes that as soon as the “peak infection rate” has been achieved, things in the market will fully normalize and equities will back to new all-time highs in a jiffy.

At this point, it likely doesn’t surprise you that we do not hold this view and there’s about 50 different charts we can point towards to strengthen our argument. When everyone agrees on a singular thing (like the oncoming recession and impending market collapse in August 2019), the exact opposite tends to occur. The broad assumption is that the economy will return 100% back to normal and it will be as if this pandemic never occurred; at least for most of us. Unfortunately, that’s not how our current economy is structured and *IF* this is the bottom in equities and *IF* people assume the Fed’s “stimulus” to be successful, then we are looking at another 10+ years nearly identical to that of the last 10. Fictitious economic growth with an inaccurate unemployment rate (please don’t look at the participation rate!!), while equity markets do nothing but float higher and higher and higher (look, growth!). Government debt will continue to balloon while the Fed balance sheet will have to rise indefinitely. It really is sad. There is no other word for it. Our economy is a farcical ponzi-scheme that greatly benefits the ultra-rich, broadens the wealth divide dramatically, and does nothing but rob from future generations.

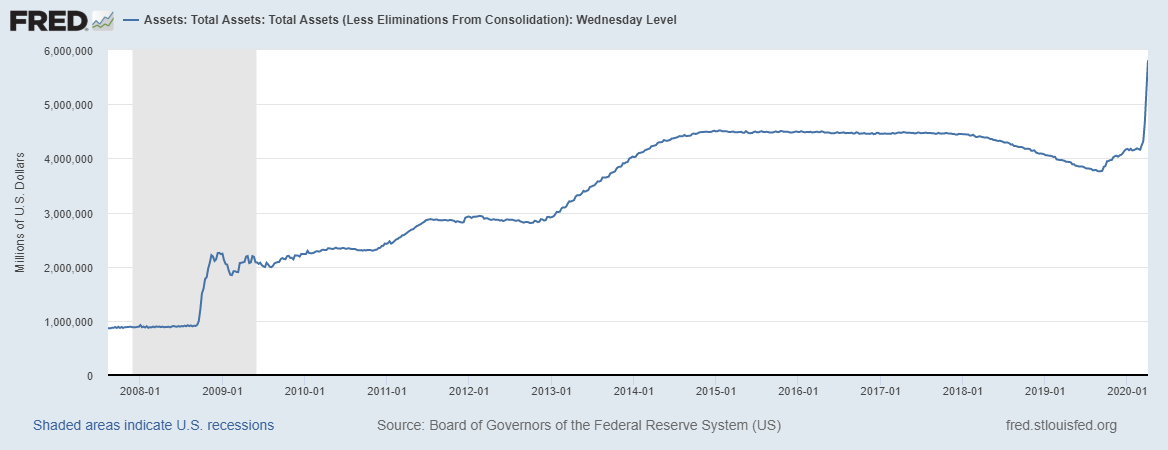

So the question then, is, “what matters?” The economy and fundamental picture have been completely irrelevant to US equities for a decade and this does not appear like it will change anytime soon. This equity market proves, time and time again, that there is one chart that matters MORE THAN ANYTHING ELSE IN THE WORLD. Not the pandemic, not bond prices, not the price of crude oil, but whether or not the Fed balance sheet is increasing. And boy, is this thing launching like a rocket. See for yourself.

This is the largest increase in $ terms of the Federal reserve balance sheet EVER. This will likely round off to near 50% of total GDP for the US before they calm down their pace. It is impossible to even fathom what that means. The biggest issue with this, is the increase in the Fed’s balance sheet does NOTHING to help the real economy. There are mountains of data to prove that. The one thing the Fed’s balance sheet increasing does help however, is inflating asset prices, most notably equities which have a whopping 70% correlation with the Fed’s balance sheet. I mean, come on. This game isn’t even fun anymore. There are no rules and nothing matters. If this chart is going up, stocks are eventually going up. Enough said.

The last decade of our economy has been completely fictionalized for broad sectors of the economy. The ultra-rich have ensured they will stay ultra-rich and have received multi-trillion dollar bailouts. Don’t worry, you’ll get a $2,000 check in the mail sometime soon though. We are remarkably displeased with the broken system that needs to be torn down so our children and grandchildren can prosper.

Emotions aside, if you want to dive back in this market, by all means, please do. But equities do not present a “value” opportunity here. Valuations have come down from 95th percentiles to 85th percentiles in terms of the historical “expensiveness” of the market. The dollar is still rising, USD/CNH is holding above 7.1, crude is below $30, the VIX above 40, and the 10-year treasury is at 0.65% (another data point that is very difficult to fathom).

Everyone and their mother wants stocks to rise, including the Fed and US Government. Seems their wishes are coming true, but is the bottom in? Our gut and nearly every other indicator says no. Let’s see what matters more, fundamentals or the Fed balance sheet. Time will tell.