To Infinity… And Beyond!!

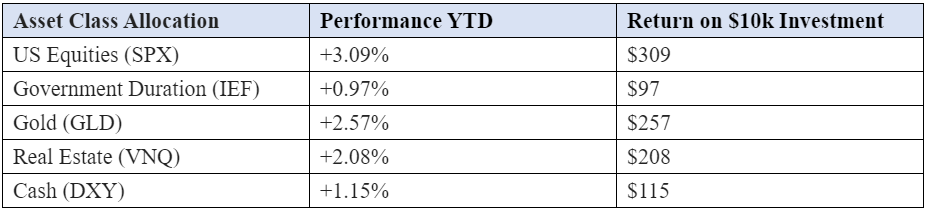

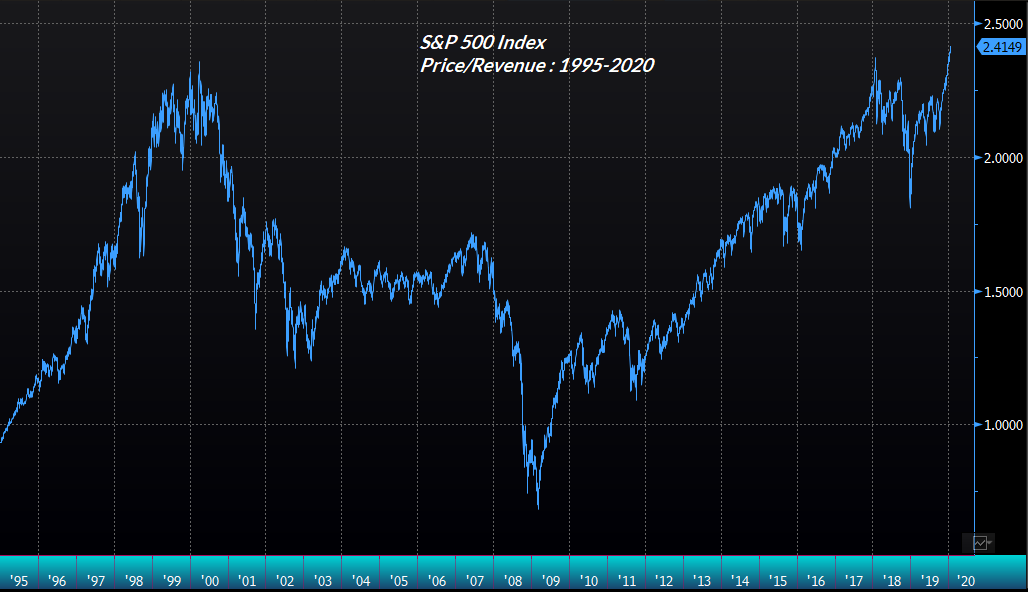

The S&P 500 keeps chugging higher and higher, seemingly with no end in sight. It’s been more than 72 trading days without a 1% pullback and the basket of stocks recently traded at a ratio of 2.42 price/sales which surpassed the ultimate valuation peak of the S&P 500 during the market top in 2000 (see chart below). Now, that said, these valuations, extremes, and speculative manias (see Bitcoin) can extend for very long periods of time. However, may we remind you that from the market top in 2000, it took more than 12 years and an additional recession for the S&P 500 to surpass the ’00 market peak. That’s a long stretch of time, no matter how you slice and dice your investment horizon (which doesn’t even include inflation adjustments).

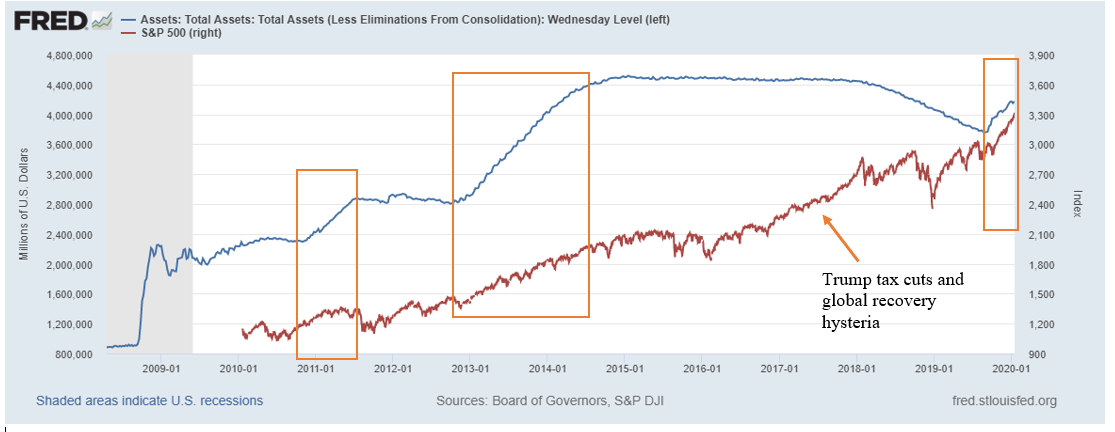

Even with that said, we are redacting our sell recommendation on US stocks and are switching to neutral. The Federal reserve is increasing its balance sheet at a breakneck pace, not seen since ‘08 (we don’t need to be the ones to remind you what that year was like…). Investors believe that an increase in the Fed’s balance sheet is very positive for the economy and introduces “liquidity” and can be considered “stimulus”. Simple research nullifies those claims so fast, but regardless, the market will react how it will and history shows us that as long as the Fed’s balance sheet is increasing, US equities will continue to float higher and higher (reference chart below). The Fed at this time has not specified when they intend to decrease the pace of balance sheet expansion – some speculate February, others believe it could extend throughout the year.

Additionally, there is speculation and chatter that the White House is going to announce tax cuts in 2020, directly targeting middle-class income tax. History shows that income tax cuts tend to produce nearly a 1-to-1 translation into consumer spending. May we remind you how equities reacted to the start of FY18 tax overhaul? The Trump administration has made it abundantly clear that they will do anything within their power to keep equities rising.

These two ridiculously powerful forces standing steadfast behind the stock market have proven to be more powerful than historic valuations, dismal prospective 12-year returns not seen since 1929, continued economic data deterioration, and negative revenue/EPS growth for the broader market. The question is not if, but when does reality set in for the equity market? Our guess in 2019 was wrong being that it is “soon”. Given how that year played out, we have to reduce our overall recommendation to neutral. If you would like to buy here, feel free, but the prospective market returns should not be taken lightly; do-so with caution and stick to your time horizon.

Until then… keep trading like this guy, because it certainly has been working.